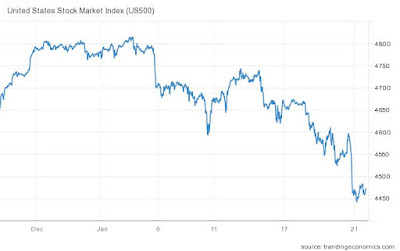

The SP500 is having a cow, man.

|

| Oof! |

Since I'm no longer contributing to my retirement fund, I can't wave it away and say, "Well, that just makes the stocks I'm buying cheaper!" I've been wondering whether or not I should park my money and wait for the rout to end.

Then again, is this just a temporary rout?

What happens when Omnicorn fades away in the US, just like it has in South Africa and now in the UK? The UK recently ditched all Wuhan Flu restrictions.

British Prime Minister Boris Johnson announced that England will scrap all restrictions, including mandatory isolation.

That will happen here, despite the best efforts of our bed-wetting Elites. My thinking is that when it does, it will have a significantly positive impact on the market and the economy. The empty shelves in the stores are at least partially due to workers out of action due to Omnicorn infections. Dittos for the supply chain crisis in general. Omnicorn is a very short, very sharp spike, so we will be past the problem in a couple of weeks.

Instead of joining the panic, I'm going to sit tight. There could be something else at work and I might be dead wrong, but that's my thinking right now.

Bonus Data

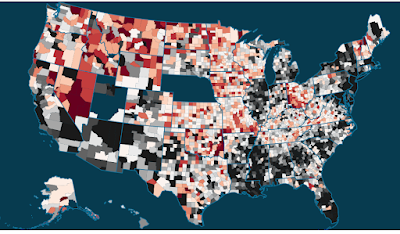

Check out all the sub-1.0 reproduction rates for the WuFlu. It's glorious. Note that Rt represents the number of new infections created by each infection. If Rt = 2, it means that you getting sick gets 2 more people sick. If Rt is less than 1, the green parts of the graphs, it means the infection is receding as each sick person gets less than 1 other person sick.

Check out this map. Dixie for the win! Darker gray means lower Rt, redder red means higher Rt.

3 comments:

I have been watching the data closely (obsessively?). The case rates still sound high but the data for San Diego county and the US as a whole have both seen the peak (the seven day averages peaked on or about the 11th). Death rates are not so clearly peaked but the number of deaths is so small (compared to say the previous Delta wave). For example, in San Diego County the 7 day average deaths went from about 4.5/day to its current value of about 6.5. The peak is probably still another week or so away.

There was an interesting reveal from the UK (because of a FOIA). The data cover March 2020 until the end of Q3 of 2021. The number of people labeled as deaths from CoViD is 137,133. The FOIA data says the number of deaths solely from CoViD is only 17,371. Also the average age of CoViD deaths indicates that the life expectancy for males was only 7.0 weeks less than the otherwise expected life expectancy and it was about 0.5 weeks MORE for women. I have serious doubts if the result for women is statistically significant, the difference for men might be statistically significant, but that is unclear. If you want a link to the source: https://youtu.be/9UHvwWWcjYw

The think about the stock market is, I don't really understand the basis for its valuation. One would think that the value of the stock market would increase with the value of the companies, and that the value of the companies would increase with increasing GDP.

BUT . . .

The St. Louis Fed plots the Wilshire 5000 (which is an estimate of the total market capitalization) versus GDP here:

https://fred.stlouisfed.org/graph/?g=qLC

Up until about 1995, the Wilshire 5000/GDP ratio was between 0.2 and 0.5. But then it escalated quickly to pass 1, followed by the 2000 market crash bringing it close to 0.5. Then it came back up to close to 1, followed by the 2008 market crash back to 0.5. Then it escalated again, even faster, until as of about July it hit 2.5.

It certainly looks to me like this indicates that market valuations increased dramatically more than was justified by increases in production. Why? I don't know. But I suspect a massive market bubble, just hanging there. Will it pop? If so, when? I can't answer that. And maybe the analysts are right, and stock really is more valuable for some arcane reason that they aren't able to explain to me satisfactorily. But, it worries me. And I have a hard time having faith in the stock market.

I find it helpful to focus on growing dividend income rather than on fluctuating stock values.

It allows you to be totally chill at times like this.

It works best in brokerage accounts where you can see the dividends hit, but you can estimate it even on funds in your 401(k). Assume you're getting 1.5% dividend yield on US stock funds, and 2.5% on foreign stock funds, and those dividends will grow roughly inline with GDP growth over the long term.

Post a Comment