This is going to be a long and wordy post, so feel free to click away now.

First off, I would argue that there are massive economic forces at work that drown out everything else. The biggest of these is the spending binge that Obama and the Democrats have begun. Fred Barnes had this to say about Obama's start.

When Barack Obama met with TV anchors at a White House lunch last week, he assured them he likes being president. "And it turns out I'm very good at it," he added. Well, not exactly. What Obama is actually very good at is campaigning. He did it for two years as a presidential candidate, and it's pretty much what he's been doing in the six weeks since he was sworn in ...Right now, we are living in the euphoria that accompanies a credit card buying spree at the mall. Every store is open and our plastic is out. We're rushing here and there buying everything we've ever wanted. Obama has made no move at all to stop the Democrats in Congress from getting anything they wanted. Earmarks festooned the recent Stimuloid Porkgasm™ and infested the omnibus spending bill he just signed and he didn't make a peep. In fact, he claimed they weren't there. He has put forth a budget that is truly monstrous and promises gargantuan deficits. The Democrats in congress are larding it up with more earmarks and rushing to pass it as fast as they passed the Porkgasm.

He talks about "hard choices" but hasn't made any. With large Democratic majorities in Congress, he's free of worry about rebellion on Capitol Hill...

But there's a problem. Candidates don't have to deal with reality. They talk about the wonderful things they can accomplish as if advocating them is the same as achieving them. They live in a world of political make-believe in which everything from reconciling conflicting interests to paying for costly programs is easy.

That's the world Obama continues to inhabit. Like a candidate, he's a quick-change artist, constantly switching roles. Twice last week, he insisted he doesn't favor "big government." Then he proposed a budget that would vastly expand the size and reach of the federal government, add $600 billion to the deficit, and produce a one-year shortfall of $1.2 trillion (or more).

That's the situation, now here are the predictions.

Short version: There is no one left to fund this spending spree. We will end up repudiating all this debt by printing money and inflating it away. That will lead to an increase in the minimum wage, higher unemployment, more debt and finally, wage and price controls.

Long version: It doesn't matter how safe Treasuries are if there's no one left to buy them. That's where we are right now. Foreign governments, all dealing with their own internal problems, don't have any money to lend us. Japan's economy is getting killed. Europe is in a financial meltdown worse than ours. That leaves China as our last hope for loans.

Forget it. Their economy is far worse than they let on. Asia economics expert Brad Setser is starting to wonder about them.

Throw in some indirect evidence that China slowed quite sharply at the end of last year, and there isn’t yet much evidence that Asia is going to help pull the rest of the world out of its slump. Right now Asia’s sharp deceleration implies it is adding to the forces that are pulling the global economy down, not propping it up. The IMF’s global forecasts — which presume that growth in India and China keep output in the emerging world from falling as sharply as it is expected to fall in the mature economies — consequently still seem on the optimistic side.What evidence is there that our credit line has run out? Take a look at what Across the Curve has been blogging over the last few days. Here's some samples taken from various recent posts.

Over the course of the afternoon I did locate some (bond) traders who had observed real end user selling from investors who were casting their financial vote on the Obama budget. Those sellers looked at the budget and apropos Roberto Duran fighting Sugar Ray Leonard they cried, “no mas.” ...Going back to the issue at hand - paying for the spending spree - where else can we get the money? How about retirement accounts? Well, I would argue that anyone who could move their 401(k) out of the stock market and into Treasuries has done so already, or at least the majority has. There aren't any investors with money left to invest on the scale Obama needs. Remember, we're talking about $2T+ budget gaps. He needs 50 Bill Gateses to give him all of their money this year, 50 different ones next year, 50 more the year after that ...

I think that an era of unheard of concessions for Treasury issuance is possible too. The funding needs of the Treasury are prodigious and given the details of the budget released today it will only increase in the near term. The wholesale market ( primary dealers) has shrunk in size and the amount of balance sheet available to those in the market has contracted, too. I think that it is only a matter of time until demand slackens and the Treasury faces 10 basis point and 15 basis point tails on a regular basis (A tail is the number of basis points between the level at which the issue was trading in the brokers market and the level at which the auction stops.)

It has happened in other markets and it seems only logical to me that it should happen in this market also. If that pattern were to develop. I think it would force the hand of the Federal Reserve and would hasten their entry into the market as a buyer of Treasuries. (Emphasis mine. This means printing money to cover the debt.) ...

Prices of Treasury coupon securities tumbled today as investors drowned themselves in the spittle of never ending Treasury issuance. From the perspective of bond traders the recovery in the stock market added to the woes of the fixed income markets. We are approaching a junction at which fundamental economic data does not matter. (Emphasis mine.)

How about if we tax the rich? Our Prelate the Primates has something to say about that.

A tax policy that confiscated 100% of the taxable income of everyone in America earning over $500,000 in 2006 would only have given Congress an extra $1.3 trillion in revenue. That’s less than half the 2006 federal budget of $2.7 trillion and looks tiny compared to the more than $4 trillion Congress will spend in fiscal 2010. Even taking every taxable “dime” of everyone earning more than $75,000 in 2006 would have barely yielded enough to cover that $4 trillion.So China doesn't have the money, the rest of the world doesn't have the money, retirement accounts don't have the money and those %#@^%@^&* rich swine don't have the money. How about those greedy pigs in big business?

Exxon is the biggest big business out there. What if we taxed every penny they made in profits? Well, they made $81.8B in profits last year and we took $36.5B of that in taxes already. That leaves only $45.2B left. Even if we took it all we would be left with this subtraction problem:

$2,000B - 45.2B = 1,954.8B

We would need to find an additional $1.95T to pay for the spending spree.

So the rest of the world doesn't have money to loan us, even if we killed all the greedy, rich people and harvested their organs we wouldn't have enough and gutting those corporate fatcats won't give us enough money, where does that leave us?

The Fed.

The inescapable conclusion is that Obama and the Democrats will simply print the money they need. Here's where the predictions come in.

Once you commit to printing money to pay your bills, your currency become a dangerous thing for foreigners to hold. I'm not willing to go all the way like Peter Schiff and claim that the dollar will no longer be the global currency, but I am willing to predict that once the Fed starts buying Treasuries in earnest, global demand for them will dry up. Would you buy stock in a company that issued endless shares? Of course not.

Once global demand dries up, it will force the Fed to take a larger and larger role in funding the deficit. Dollars will vomit forth from the Fed with no corresponding increase in real wealth in the country. That's inflation. Once inflation begins, the real value of the minimum wage will fall. What do Democrats do when that happens? Why, they raise the minimum wage, of course. Raising the minimum wage has been repeatedly shown to increase unemployment. Increased unemployment leads to lower tax revenues and increased government spending. That leads to larger deficits, which will have to be funded by more printed money.

The end result will be a decline in real wages and a decline in savings. What's the point of putting money in the bank if it's just going to erode away? Here's another prediction. Wage and price controls. If inflation heats up before the next congressional election, what do you suppose the interventionist Democrats will do? Will they allow the greedy corporations to make obscene profits on the backs of the poor by raising prices on the things people need to survive? Hardly.

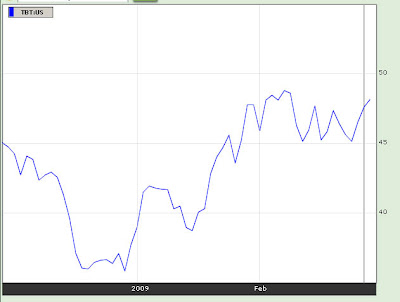

How will you know if this is happening? Well, the first thing to watch are the Treasuries. If you watch TBT, you can get a feel for what is happening. TBT shorts long-term Treasuries. If TBT rises, that tells you that the US is trying to borrow more than people want to lend it. Here's the recent 3-month chart of TBT.

As the global crisis unfolded, entities around the world threw their money into Treasuries as a safe haven. TBT went way, way down. It should have kept going down as the crisis has only gotten worse in the last 3 months. Instead, it's rising because "we are approaching a junction at which fundamental economic data does not matter."

The next thing to watch for is an announcement by the Fed that they will step in and buy Treasuries. They will have to because falling Treasury prices mean higher interest rates - interest rates that the government has to pay on the debt.

After that and perhaps before, watch for a dropoff in foreign purchases of Treasuries, particularly from China. Some countries will start selling them in order to pay their bills.

Finally, watch the price of gold. As these things start to happen, more and more investors will stop seeing Treasuries as a safe haven and will look for another one. Gold isn't an investment, it's a way to stabilize your financial worth. I usually think gold is a stupid thing to buy, but in times like this, when nothing else seems safe, it's attractive. (Note to readers: I am not recommending you go out and buy gold! This is a thought exercise and not investment advice. Gold may be a good idea, but you need to do your own research on it.)

There. I went way out on a limb and made wild predictions. There are probably only 3 or 4 people still reading. I hope you enjoyed it. In a few months I'll likely come back and repudiate all of this and delete the post, claiming I never wrote it at all.

:-)