Shiller's 'CAPE ratio' is among the most widely-used measures of whether markets are cheap or expensive, and he got the Nobel Prize for economics last year for his work on market volatility and asset prices.Then again, something is always sounding the alarm. If you'd been fed a steady diet of ZeroHedge and Mish Shedlock, you'd have kept your money in a mattress and missed out on years of very nice asset growth. Still, this is Robert Shiller we're talking about here, not some wild-eyed, survivalist nut.

So it's chilling when he tells you that his CAPE ratio for US stocks has reached its present level on only three times in the past 130-odd years, and that those previous occasions were 1929, 2000 and 2007, each followed by a crash.

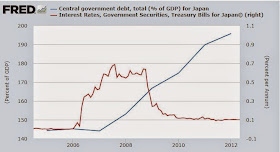

Having been raised to hate borrowing, I've blogged ad nauseum about national debt levels, but nothing ever seems to come of their growth. Except in Argentina, but that particular social justice fascist basket case* is always blowing up. National debts keep going up and up and up without any apparent repercussions.

Sort of like when you build a house of cards and make it taller and taller and taller. So what's going to jiggle the table?

I spent a little time meandering around the FRED charts and graphs and came up with two to bore you.

Japan

China

Of course, if ISIS blows some bridges, power lines or aqueducts in the US first, then all bets are off.

I still feel really uncomfortable about the market, sort of the way I felt in 2007. I guess if there was some obvious marker out there, everyone would see it, not just some dilettante blogger. This post is pointing out that everything is set for a fall. Secondarily, if the CAPE ratio is historically high, how much higher can the market go? How much are you risking if you take money off the table for a while?

* - As opposed to the social justice fascist basket case Obama and Democrats are endeavoring to create here in the US.

"I guess if there was some obvious marker out there, everyone would see it, not just some dilettante blogger."

ReplyDeleteI think this sums up the fundamental problem of economics: the economists and money managers themselves are a part of the very thing that they are trying to describe. As in, as fast as one person comes up with models that can be used to predict the economy, other people immediately start coming up with ways to subvert these models to their own benefit. At which point, the model ceases to work. Which is probably what gives economists their reputation for not knowing what they are talking about.

A secret society of economists, all sworn to work together in tandem, might be able to do better, but, pretty much by definition, we would never be able to know about it.